& Construction

Integrated BIM tools, including Revit, AutoCAD, and Civil 3D

& Manufacturing

Professional CAD/CAM tools built on Inventor and AutoCAD

The technologies of the Fourth Industrial Revolution (Industry 4.0)—connected robotics, 3D printing, cloud computing, artificial intelligence (AI), and the Internet of Things (IoT)—made smart manufacturing possible and sped innovation to a dizzying clip.

The dawn of mechanical manufacturing happened during the First Industrial Revolution at about the end of the 18th century, powered by water and steam. Two long centuries later, electricity enabled the Second Industrial Revolution’s mass-production assembly lines and division of labor. Rapid progress led to the Third Industrial Revolution around 1970, when computers and information technology automated some industrial processes and led to more sophisticated communication.

Since the term Industry 4.0 was coined in 2011, its associated technologies have developed to allow a data-rich, interconnected, and highly automated form of production called smart manufacturing.

According to Paul Wellener, vice chairman and US Industrial Products and Construction leader at Deloitte LLP, smart manufacturing refers to the widespread digitization of all manufacturing practices, from the factory floor to all aspects of business. This includes product design, supply chain, production, distribution, and sales.

Smart manufacturing leverages Industry 4.0, which is characterized by interconnected cyber-physical systems such as intelligent robots and machines that can self-diagnose and warn of possible failures. The proliferating IoT brings more powerful devices and machines with smart sensors that upload continuous streams of usage data to the cloud for analysis.

Those Big Data sets are crunched using AI with machine learning that becomes more accurate and predictive as it absorbs more data. Automation and data connectivity create more agile supply chains, in which ships and trucks “talk” to warehouses, autonomous or semiautonomous vehicles, and drones. Mobile robots and cobots (collaborative robots) are also folded into this process, making shipping and logistics more automated.

Smart manufacturing helps manufacturers become more efficient, stay ahead of the competitive curve, and explore new business models and practices.

Businesses can adopt smart manufacturing to help streamline processes, increase productivity, stay competitive, and prepare for the future—including for unprecedented events, such as a pandemic.

An ongoing poll from the nonprofit Manufacturing Enterprise Solutions Association (MESA) asks companies what the main challenge is that’s slowing their progress toward smart manufacturing. About 58% cited financial concerns or lack of knowledge about the related technologies. To be sure, adopting smart manufacturing requires significant investments of financial and human resources and involves some risk.

However, the 2019 “Smart Factory Study” from Deloitte and the Manufacturers Alliance concludes that any manufacturer, whether it has begun smart-factory initiatives or not, can derive value for its business by doing so—and that the value of those initiatives generally outweighs the financial and operational risks.

The study broke respondents into two groups: Group A (49% of companies) had no ongoing smart-factory initiatives; Group B (51%) had some level of ongoing smart-factory initiatives. The study determined that Group A’s productivity index for 2015–2018 likely declined 2.3% per year while Group B saw average annual productivity rise 3.3% during the same time period. Furthermore, the Group B companies experienced a 10% average increase in production output and an 11% average increase in factory capacity utilization.

Most of the companies not yet implementing smart manufacturing still saw its importance. “In the study, 86% of manufacturers surveyed believe that within five years, smart-manufacturing solutions will be the main driver of competitiveness,” Wellener says. “This highlights how important smart-manufacturing capabilities will be to enable manufacturers to be competitive in the coming years.”

Regardless of economic slowdown and supply-chain disruptions resulting from the COVID-19 pandemic, now is the time for businesses to consider smart-manufacturing initiatives to stay competitive. In fact, a Deloitte and Manufacturers Alliance report released in October 2020, “Accelerating Smart Manufacturing,” revealed that many manufacturers were expanding smart-manufacturing technologies in 2020 and were likely to continue that into 2021.

“Executives shared examples of installing computer-vision systems to enable virtual plant tours for customers; adding wearable devices for line workers to signal when they cross into a coworker’s 6-feet personal space; and even quickly adding cobots to augment the workforce, as workers can’t be shoulder-to-shoulder on the line any longer,” Wellener says.

Srinath Jonnalagadda, Autodesk vice president of go-to-market strategy and marketing for Design and Manufacturing, says it’s only a matter of time before all manufacturers will have to adopt smart-manufacturing technologies. “This is really an existential issue,” he says. “My view is that there’s no other path except for the physical world and the digital world to converge.”

For businesses interested in smart manufacturing but intimidated by financial or technical barriers, the good news is that they do not have to transition factories in one big leap. In fact, the “Smart Factory Study” shows that small steps often lead to big wins. Successful companies from the study usually started by securing support from executives in the C-suite—especially the chief technology officer—and launching multiple small projects with low initial investments. By tying those projects to measurable business metrics, they could use any early successes as an incentive to seek additional incremental investments.

Jonnalagadda recommends that manufacturers starting out on a smart-manufacturing journey should begin by making their analog data digital: Eliminate manual analog processes, and find a system that captures everything in one digital database. That’s the foundational data on which to build feedback loops by inputting more information from factory-floor processes. This additional input could come from sensor data, but it could also be from workers inputting data at different points in the process.

“As you capture more and more data points, you get more insights into what’s happening,” Jonnalagadda says. “And it gives you a better chance to actually understand the status quo. Then, you get that path to enlightenment, so to speak. Once you have awareness of what’s happening on the factory floor, then you can uncover the bottlenecks.”

Once manufacturers’ problems are revealed by data, they can start thinking about making changes on multiple dimensions—that’s where introducing more computation and algorithms can help. “You let the algorithms give you different exploration possibilities so you can figure out the best path forward, and that is the Holy Grail,” Jonnalagadda says. “Now, you have a digital backbone. You have input and feedback loops giving you insights and the help of algorithms that give you options for continuing to refine and optimize factory-floor operations.”

Smart technologies are continuously developing. For example, smart manufacturing does not require a new 5G cellular network, but 5G connectivity reduces the reliance on hardware and Wi-Fi, can simplify setups, and offers greater bandwidth than 4G.

The following technologies make up the tenets of high-tech smart manufacturing, but they are not discrete; very often, a device, machine, or system will incorporate several of them. For example, an IoT device may have sensors wirelessly connected to the cloud and have processors embedded with AI that can send alerts or make process decisions independently.

AI/machine learning goes hand-in-hand with smart-manufacturing data analysis, as it can process data and recognize patterns in the data much faster than people. Some level of AI is often embedded into smart factories’ cobots and other robotics systems. As the price of AI drops, it is also being used in the microprocessors of edge computing IoT devices and smart-factory machines. AI-based computer vision can also derive insights from video of the factory floor. For example, Drishti’s AI-powered analysis of manual assembly lines can provide worker training, reduce product defects, optimize processes, and more.

Augmented reality (AR) and virtual reality (VR) applications have different smart-manufacturing use cases. They are especially relevant at the moment for on-the-job training to help workers bridge the widening skills gap. Since the pandemic’s onset, the smart-manufacturing sector has doubled down on AR/VR for training and bringing in remote expertise for repairs or other guidance. With Microsoft’s mixed-reality HoloLens 2 goggles, for instance, a factory-floor employee can receive instructions from a remote expert who’s essentially seeing through the employee’s eyes.

Smart manufacturing’s use of robotics is also becoming more diverse and collaborative, as cobots become increasingly popular due to social-distancing mandates. Robots and automated machines vary in levels of AI, autonomous decision-making, sensing ability, communicative ability, and mobility. But, generally, in smart manufacturing, robotics systems gather a lot of data and are well-connected to the cloud and the smart factory at large.

Additive manufacturing, also known as 3D printing, has revolutionized rapid prototyping and now supplements traditional manufacturing with finished products—or even infrastructure like small-scale buildings and bridges. It’s expected to eventually be used in mass production, as well. Meanwhile, hybrid manufacturing combines metal additive manufacturing with subtractive manufacturing on a single machine to further reduce material waste and produce parts quickly.

Big Data touches every other part of smart manufacturing, and in some cases, data defines the “smart” aspect of a technology. Data-driven smart manufacturing feeds machine learning and relies on the cloud for storage and processing. But Big Data analysis is also key to areas of smart manufacturing beyond the factory floor, informing decision-making in logistics, risk assessment, cost structures, growth strategies, quality control and improvement, build-to-order and other sales patterns, and after-sales services.

With cloud computing, IoT sensor data is stored and analyzed with AI/machine-learning algorithms on off-site servers. An example of what the cloud can do for smart manufacturing is the Volkswagen Industrial Cloud, which combines all data from 122 Volkswagen Group facilities and processes it in real time to make improvements. Long-term, Volkswagen’s goal is to connect more than 30,000 locations from 1,500 suppliers worldwide to the Industrial Cloud and possibly create a market for smart-manufacturing software.

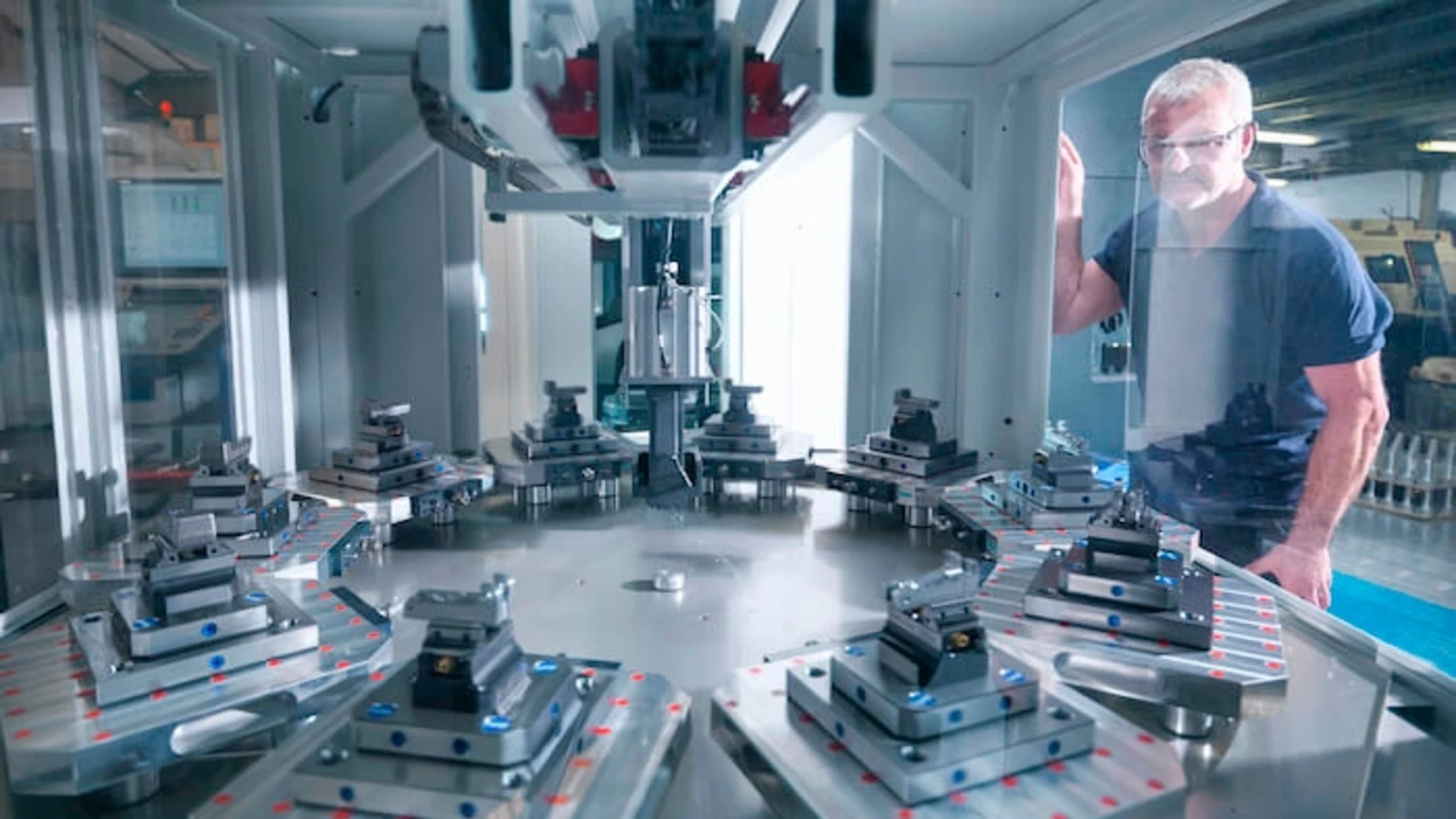

Advanced computer numerical control (CNC) machines perform precise multi-axis milling, lathing, cutting, drilling, and other operations from the designs and models of computer-aided manufacturing (CAM) software. Often in smart manufacturing, CNC machines have wireless sensors as part of the IoT.

Design for manufacturing (DFM), or design for manufacturing and assembly (DfMA), is a design methodology that enables and optimizes prefabrication through a set of design choices and principles. Products and components are designed specifically for manufacturing and to make manufacturing processes easier and more cost-effective. It involves designing and producing with specialized CAD and CAM software.

Smart-manufacturing devices, machines, robots, and so on are typically part of the IoT, meaning they include wireless network-connected sensors that upload data for analysis. With the plummeting cost of sensors, low-cost processors are also increasingly part of IoT devices, which means performing computing tasks locally before uploading to the cloud. That’s known as edge computing. The term IIoT (Industrial Internet of Things) refers to IoT machines on a production line, which can usually perform predictive decision-making based on input data that lower costs and waste.

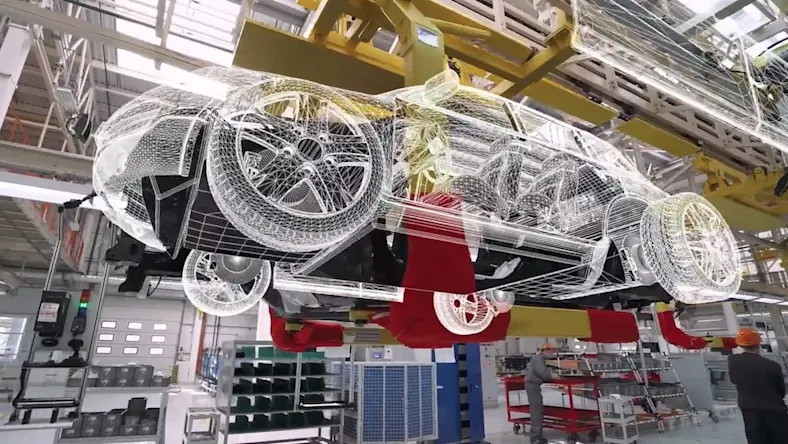

Smart manufacturing uses simulation software to create digital twins of physical parts and products, which can be tested, validated, and optimized digitally before manufacture. Simulation becomes more valuable the closer the digital twin gets to a precise physical representation.

Smart manufacturing can help a business become much more efficient with its resources, enhance worker safety, and facilitate worker training. It can also make a business more agile, according to MESA Knowledge Committee Chair Khris Kammer. “Look at the number of companies during COVID-19 that pivoted to manufacturing other things, whether PPE or related medical devices,” Kammer says. “They could do that only because they had the agility to introduce a new product into their manufacturing environment very quickly and retool, retrain, and execute in a very rapid fashion.”

Kammer adds that smart-manufacturing firms can be agile with their products and participate in the “mass customization” trend that lets manufacturers deliver low-volume, high-variability products. This can lead to new business models based on subscriptions or “lot size one” products. “Then, instead of getting squeezed by the supply chain, you end up driving some of the innovations in the supply chain, which is exciting,” Kammer says.

Smart manufacturing has the potential to improve outcomes for individual businesses and the manufacturing industry as a whole. Another new business model that smart manufacturing has enabled, manufacturing as a service (MaaS), could help make the supply chain more resilient to disruptions like those in 2020. MaaS, or as purveyor Xometry calls it, on-demand manufacturing, matches manufacturing needs with suppliers who have the extra capacity to meet it—like “the Uber-ization of manufacturing,” Jonnalagadda says. Just as ride-share services rely on machine learning to match drivers with passengers very quickly, MaaS requires machine learning to quickly and effectively match manufacturers with customers.

The “Accelerating Smart Manufacturing” report focuses on another development with industry-wide implications: the “network effect” benefits of smart-manufacturing ecosystems, wherein many companies and entities meaningfully work together using advanced, connected technologies to meet common objectives.

Examples include COVID-19 response manufacturing initiatives, such as the America Makes additive-manufacturing community effort. It featured an online portal for designers, manufacturers, and the health-care industry to collaborate on making more than 280,000 PPE units in two months.

Smart-manufacturing ecosystems are mutually beneficial in any circumstance because they share access to collective wisdom and innovation. The report found that Fortune 500 manufacturers with more than 15 strategic alliances doubled year-over-year revenue growth in 2019 compared to those with fewer alliances. Companies within smart-manufacturing ecosystems also experienced a faster pace of introducing products and services, expanded innovation capacity, faster maturity of their digital technology, and greater efficiencies that reduced operational costs.

Some smart-manufacturing technologies inherently promote efficient resource use. Simulation software, for instance, can drastically reduce the amount of physical waste by moving many physical tests (such as vehicular crash tests) into simulated environments. Simulation can also predict the durability and lifespan of different materials and test alternate materials for end products with the lowest impact on the planet, Jonnalagadda says. DFM can also introduce sustainability benefits into a product. For example, generative design software uses AI to generate an abundance of design options that can reduce product weight and the amount of material required while maintaining strength and cost.

With the right intention, smart manufacturing can actively support sustainability goals. The Smart Factory @ Wichita (a joint effort from Wichita State University and Deloitte) will include a full-scale production line demonstrating how to join existing manufacturing assets with smart-manufacturing technologies such as robotics systems, 3D printers, 3D laser scanners, AR/VR assets, simulation and visualization software, and more. The brand-new facility is also a net-zero smart building on a smart grid, and the program aims to demonstrate how a smart-factory’s advancing technology can address sustainability by streamlining operations to reduce environmental impact.

Some Industry 4.0 advisers, such as the Bernard Marr & Co. think tank, are bullish on the potential of these technologies. They say that if used right, their optimized asset management could help regenerate the world’s ecosystem and undo the environmental damage from earlier industrial revolutions and practices.

MESA’s 2016 white paper “Smart Manufacturing—The Landscape Explained” called for industry standards for data and communication to promote interoperability between smart-manufacturing machines and software. Many others in the industry agree that this is essential to a smooth transition into Industry 4.0.

“There are a multitude of standards, a multitude of companies pursuing different proprietary formats, and the software is lacking that connectivity to all these different standards,” Jonnalagadda says. For CNC machines alone, each vendor has its own method of managing and connecting them. “That needs to change,” he continues. “There needs to be a system to connect to every type of machine.”

Cybersecurity and data protection are also top priorities; 58% of manufacturers from the “Accelerating Smart Manufacturing” report expressed concerns about data and intellectual-property theft from participating in a smart-manufacturing ecosystem.

Despite these issues—which many believe will be ironed out over time as smart manufacturing reaches critical mass, even amid an economically uncertain time—62% of the “Accelerating Smart Manufacturing” surveyed companies are continuing or ramping up their technological initiatives.

“Out of adversity often comes ingenuity and progress,” Kammer says. “There are a lot of great visionaries really trying to take hold of some of these enabling technologies to do things that they’ve never been able to do, like going from ideation and design to the fruition of a product faster than ever. I think from the combination of the newer technology and necessity, you’re going to see some great things.”

This article has been updated. It was originally published in October 2020.

Markkus Rovito joined Autodesk as a contractor six years ago and joined the team full-time as a content marketing specialist focusing on SEO and owned media. After graduating from Ohio University with a journalism degree, Rovito wrote about music technology, computers, consumer electronics, and electric vehicles. Since his time with Autodesk, he’s developed a great appreciation for exciting emerging technologies that are changing the world of design, manufacturing, architecture, and construction.

Emerging Tech

Emerging Tech

Emerging Tech